The Alvarez Law Firm Trial Attorneys

A legacy of winning when the stakes are highest

Founded by one of the most accomplished civil justice attorneys in the U.S., The Alvarez Law Firm is a boutique trial practice with an unrivaled record and reputation for courtroom results. Its win rate against the giants of Big Tobacco rank among the highest in the country. The firm’s multi-million dollar verdicts against large corporations in Pharmaceutical, Medical Malpractice and Injury cases have established key legal precedents, while delivering justice and due compensation for its clients and their families.

Our attorneys possess multi-state licenses, allowing them to practice law across various jurisdictions. This unique advantage enables us to serve clients in multiple states efficiently and effectively. Rest assured that our legal expertise knows no boundaries.

Case Results Over $1,000,000,000 Recovered.

View More Results

$43M - Verdict Lipp v. Philip Morris

$41M - Verdict Schlefstein v. R.J. Reynolds

$7M - Verdict Patient v. Coral Gables Hospital

$5M - Verdict Motorist v. Alamo Rental Car

Medical Malpractice

Our firm has 30+ years of experience winning medical malpractice cases, including misdiagnoses, birth injuries, surgical errors, and negligence that has resulted in severe injury or even death of a loved one.

Tobacco Litigation

Big Tobacco doesn’t settle. You have to beat them in court. The Alvarez Law Firm has one of the highest win rates in the nation against Big Tobacco. We have recovered half a billion dollars in compensation for clients to date.

Personal Injury

Our firm represents all manner of victims and their families who have suffered catastrophic injuries or illnesses as a result of unsafe products, premises, or any other acts of gross negligence.

From our clients

The Alvarez Law Firm was founded on these core principles: Integrity, Trust and Results. Nothing is more important to us than getting results for our clients.

View More Reviews

Mr. Borroto and his team are best in class. Mr. Borroto assisted and helped my family with our case from beginning to end with amazing results. He is ver...

The Alvarez law team was more than a law firm representing my family. The team supported and helped us through a very difficult time. Their professionalism...

I witnessed Mr. Reyes and Mr. Alvarez in trial for three weeks. The trial was intense, but Mr. Reyes and Mr. Alvarez handled every aspect with poise and co...

Mr. Reyes and Mr. Alvarez were with me from the beginning of the case to the very end when we received a favorable verdict from the jury. Watching the Alva...

Medical Malpractice

Our lead Medical Malpractice Attorney is also a trained Medical Doctor with 32 years of experience handling complex medical lawsuits. This incredibly rare combination of cross-industry expertise and experience has helped our firm win over 200 malpractice cases to date, recovering tens of millions in damages for our clients and their families. If you’ve been wronged, we can help.

Learn About Medical Malpractice

Tobacco Litigation

The Alvarez Law Firm is most known for representing victims and their families who have suffered serious health problems or even lost their life due to using or being exposed to tobacco products. We have a reputation for consistently beating Big Tobacco in court, despite their multi-million dollar defenses. If you or a loved one have lost your health due to tobacco, we’re the firm you call.

Learn About Tobacco Litigation

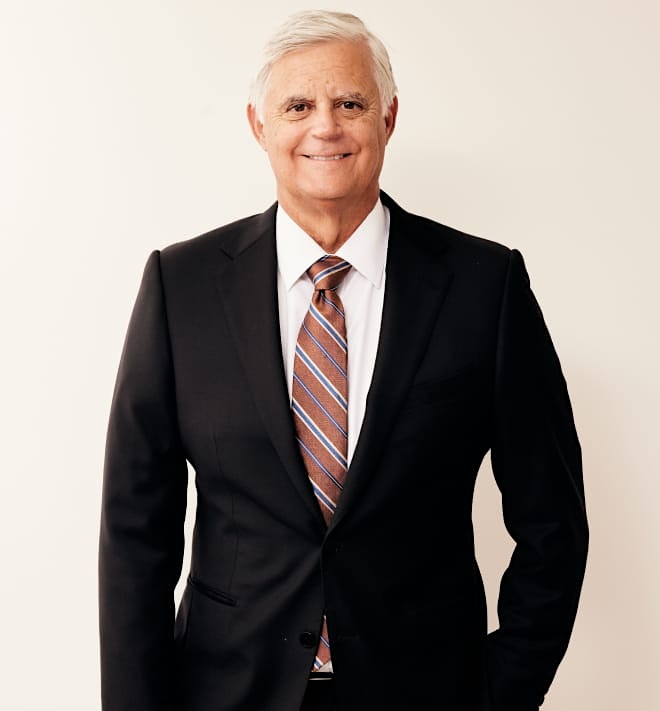

Founder Alex Alvarez

Alex is one of the top civil justice attorneys in the U.S. Over his storied 30-year career as a litigator, Alex has beaten Big Tobacco twenty-nine separate times in court, with an unrivaled win percentage. Owing to his reputation for winning high-stakes verdicts, he’s considered one of the country's leading experts in trial preparation and jury selection. When a case is too important to risk, law firms hire Alex to advise them on how to win.

The expert’s expert

Unlike what is shown in movies, trials are not won during the closing argument. Successful verdicts are the culmination of thousands of facts, variables, decisions and actions. One or two wrong choices by an attorney can upset the entire balance and lose the case. Most trials are lost before the first witness is called due to insufficient preparation or poor jury selection habits. This is why many lawyers hire The Alvarez Law Firm to assist on complex cases with focus groups, jury research and case consulting.